Executive Summary:

Overall, the VC investment climate in the first quarter of 2024 has shown mixed signals globally, reflecting both optimism and caution across various regions and sectors.

On the one hand side, the drop in global VC investment and deal count represents a decline driven by ongoing market challenges such as high interest rates, geopolitical uncertainties, and a scarcity of exits. The scarcity of exits leaves no money to be put back into the market, and heightened holding periods of VC-backed firms increase the liquidity risk for investors.

However, despite the overall turndown, we have seen significant mega deals exceeding USD 1 Bn, which implies that the market is moving towards quality, with deal value showing surprising resilience.

Similarly, valuations have seen an uptick, especially for companies that have backed their high valuations from 2021 and 2022 with a positive growth trajectory or even profitability. However, generally, it is harder to maintain valuations for companies that raised in bullish market conditions than for companies that raised last year when the market was experiencing a downturn.

The verticals AI and CleanTech continue to dominate tech deals and make up a substantial amount of deal volume. The former is driven by advancements and regulatory developments, and the latter by the urgent need for decarbonization and energy solutions.

Global VC deals continue to decline the first quarter of 2024

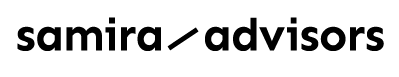

The consistent decline in global technology deals observed throughout 2023 persisted into the first quarter of 2024.

Source: Preqin May 2024

While a year-over-year comparison since 2022 indicates a continued decrease in VC deal counts, the rate of decline from 2023 to 2024 appears to be somewhat less severe than the previous year. Notably, VC investors worldwide engaged in significantly more thorough due diligence processes for potential deals, taking longer before writing checks.

The prevailing challenging economic landscape, marked by the Federal Reserve’s decision to maintain interest rates despite early indications suggesting otherwise, prompted corporations to prioritize strengthening their core operations and enhancing operational efficiencies over making new investments. According to the Q1’24 Venture Pulse Report from KMPG, there was a global decrease in Corporate Venture Capital (CVC) funding, with global investment decreasing from USD 40 billion in Q4 2023 to USD 37.3 billion in Q1 2024.

Attention is now focused on the IPO market, which has yet to display the robust signs of resurgence anticipated towards the end of 2023. Should a few successful IPOs materialize in Q2, followed by a string of others, generating substantial value and wealth that could then be reinvested into the market and VC firms may begin to loosen their purse strings, also due to pressure from LPs. The lack of viable exit opportunities has been particularly detrimental to unicorn companies and their investors. As of the end of Q1 2024, there were 731 unicorn companies collectively valued at over $2.4 trillion. These unicorns have remained within VC portfolios for an average of more than eight years, significantly exceeding the typical holding period for portfolio companies, which substantially heightends liquidity tisk for all investors involved.

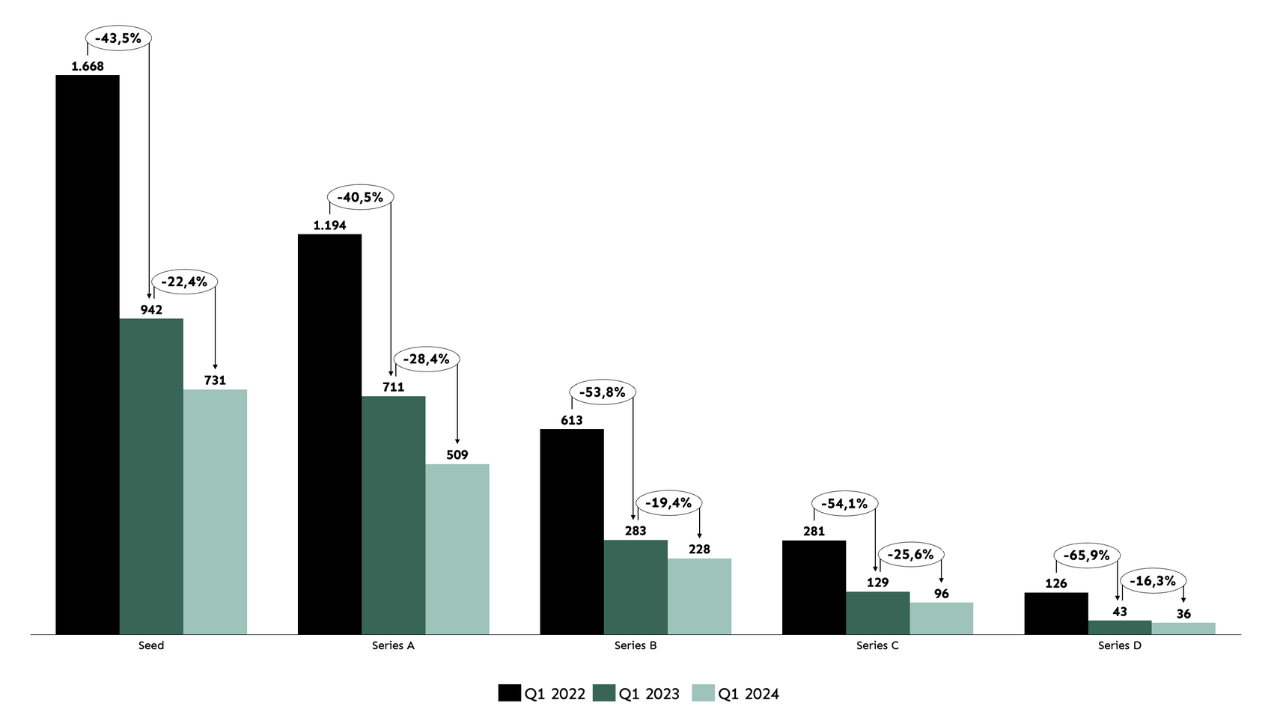

Global deal value is showing resilience

Source: Preqin March 2024

When analyzing the global tech sector’s performance, we’ve noticed a remarkable trend: while global deal count remained consistent between Q1’23 and Q1’24, aggregate deal value displayed surprising resilience, maintaining stability. This stands in stark contrast to the significant drop in deal value witnessed from 2022 to 2023. Despite a modest decline of -3.8%, notably lower than the decrease in deal count, this data hints at a potential shift to quality in the market.

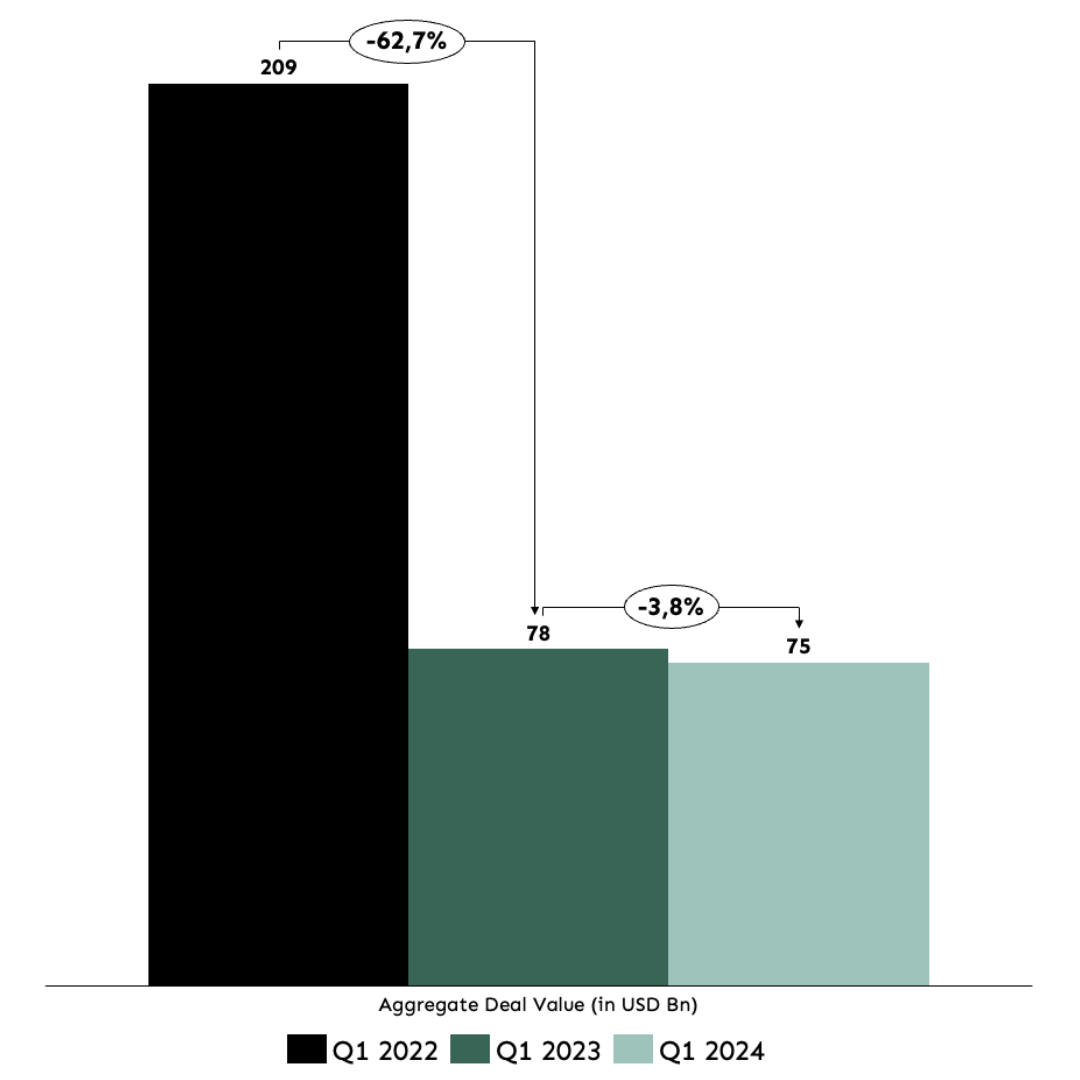

The market is shifting towards quality

The market’s shift towards quality is further underscored by the average deal size across all stages. While there has been a decline in deal counts, there is a noticeable uptick in average deal size by 25%.

Source: Preqin May 2024

This surge can be credited to various factors, including the mounting pressure on VC firms to deploy their dry powder and the rigorous selection process wherein only the most promising ventures secure funding in this demanding economic landscape.

During the past two years, startups in search of fresh capital have had to exercise growing patience. The larger round sizes witnessed in Q1 signal the much-awaited infusion of financial resources for the companies that are showing the necessary quality. But compared to Q1 2022, a lot of startups are going to be left behind.

Valuations are bouncing back, especially for companies who kept their promises

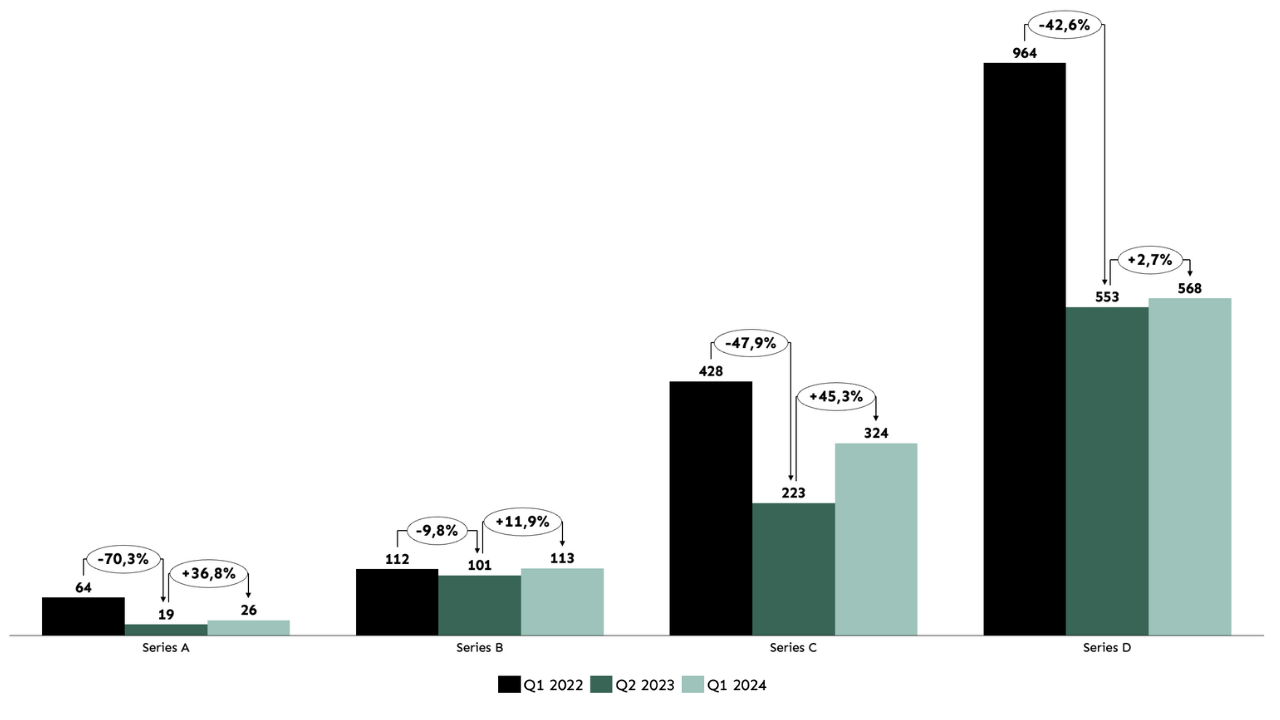

Examining Tech VC valuations reveals a consistent upward trajectory. Average valuations across all stages have soared, marking a substantial ascent in the industry. The most notable surge is evident in Series C funding, boasting a remarkable increase of +45.3%, closely trailed by Series A with a robust +36.8%, and Series B with a respectable +11.9%. Conversely, Series D companies depict the mildest growth, reflecting a modest uptick of 2.7% in post-money valuation.

Source: Preqin May 2024

Companies that saw their valuations decrease in Q1 2024 likely raised primary funding in 2021 or 2022 during bullish market conditions, with their appeal to investors declining since then. Conversely, those whose valuations increased likely raised funds in 2023 amid a more restrained market, indicating a trend where companies benefiting from previous bullish conditions now struggle to maintain their valuations, potentially leading to down rounds.

Furthermore, VC valuations are currently seeing a separation of wheat from chaff. Companies that reached a relatively high valuation in the golden times of VC, and have proven them with high growth or even profitability can now slowly start asking for higher valuations again. The ones who couldn’t back the high valuations until now are either suffering down rounds or aren’t able to raise at all.

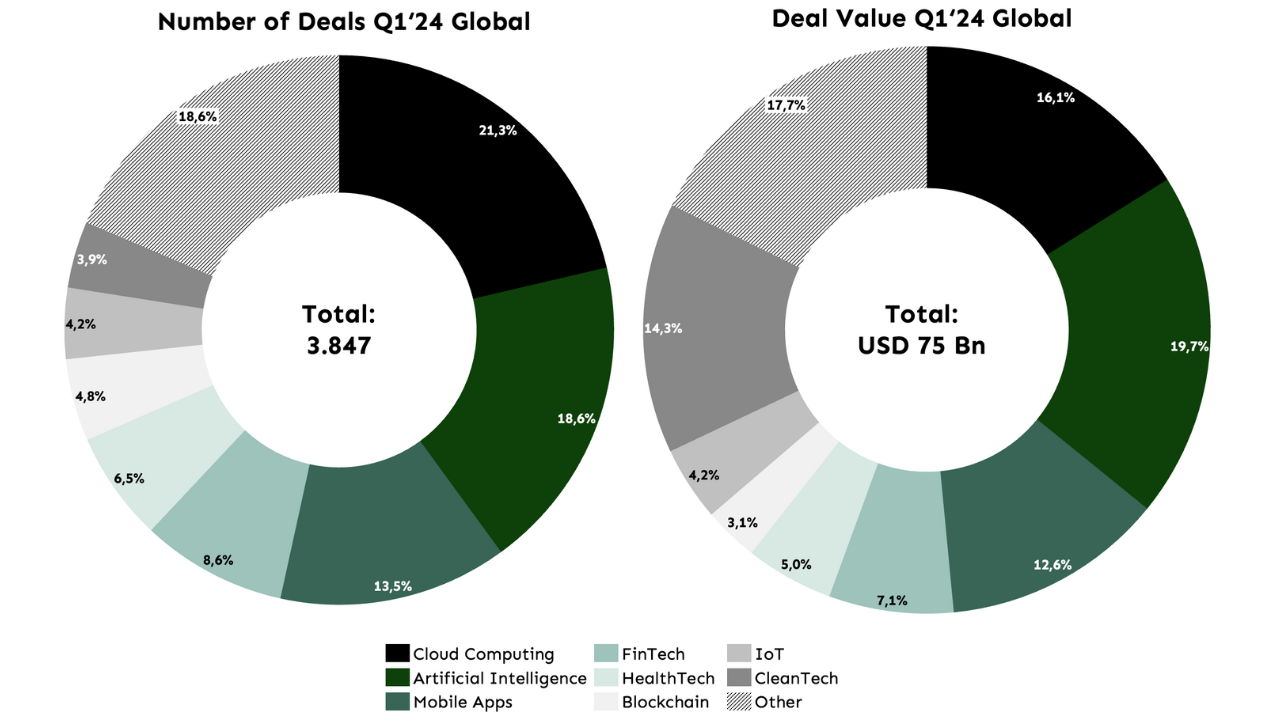

AI and ClimateTech as major focal points

In the realm of global technology VC deals, two verticals stand out in terms of deal frequency: cloud computing takes the lead, representing a significant 21.3% of all deals, closely followed by AI at 18.6%. However, when it comes to deal value, the narrative shifts, with AI commanding the top spot, comprising 19.7% of total deal value, while cloud computing trails behind. This underscores the notable premium placed on valuations within the AI sector.

Source: Preqin May 2024

Furthermore, an intriguing trend emerges with cleantech: despite comprising only 3.9% of all deals by number, it commands a substantial 14.3% of deal value. Similar to AI, cleantech defies the prevailing negative trend in VC, showcasing sustained investor confidence in its underlying fundamentals and prompting continued high levels of investment, driven by the urgent need for decarbonization and energy solutions.

The frenzy of interest in AI-driven solutions continued in Q1’24, with some of the largest deals of the quarter occurring in the space, led by the $4 billion raise by Anthropic in the US. Other big deals included YueZhiAnMian (China), Figure AI (US), Lambda (US), MiniMax AI (China), and Mistral AI (France), driven by advancements and regulatory developments.

What Samira reads

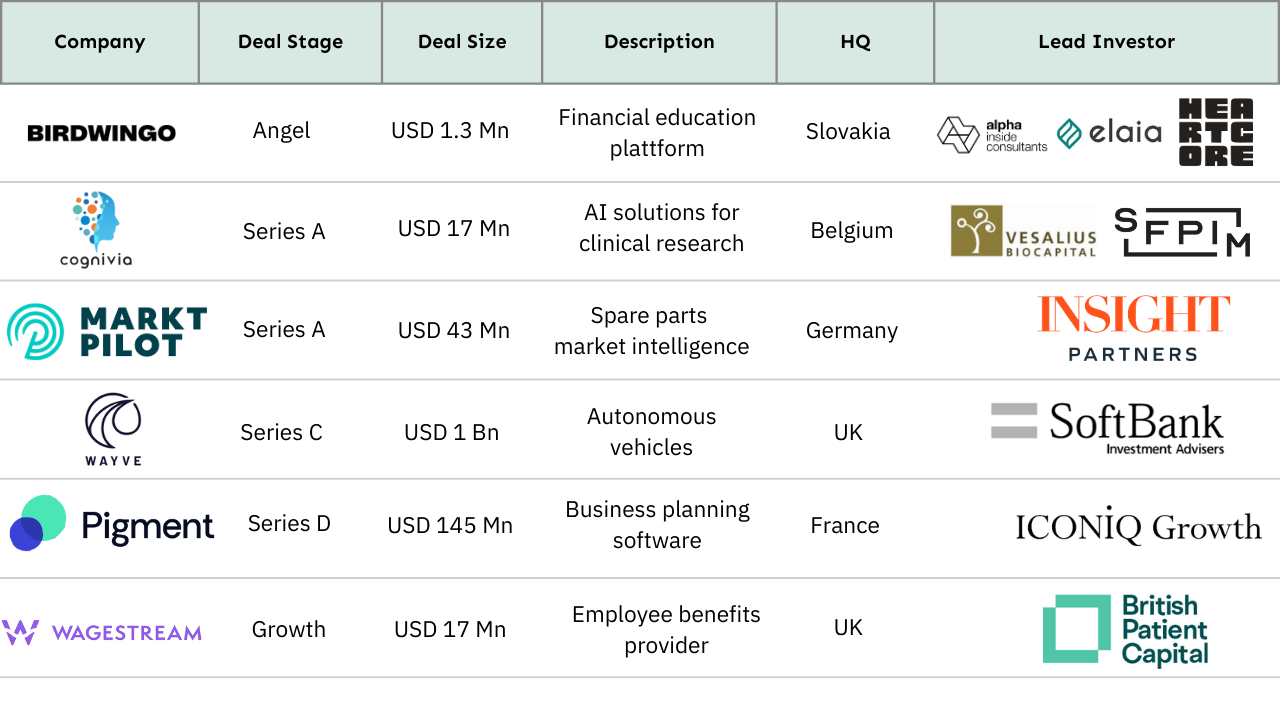

Funding Highlights

Browse through the content that we at Samira share in our #knowledge channel on Slack.

- Everything Founders need to know about Earnouts

- How to calculate your valuation as a founder

- When is the right time to sell your company

- Secondary deals grow as a part of PE exits

Did you know that we started publishing on Medium? Make sure to check it out here.